Homeowners’ insurance policies cover your roof and replacement costs when it gets damaged. However, there are specific scenarios that they may not cover. Generally, destruction resulting from an accident or act of nature will grant you the funding, not deterioration due to the neglect of wear and tear. Here’s how roofs impact home insurance rates.

How Roofs Affect Home Insurance Rates

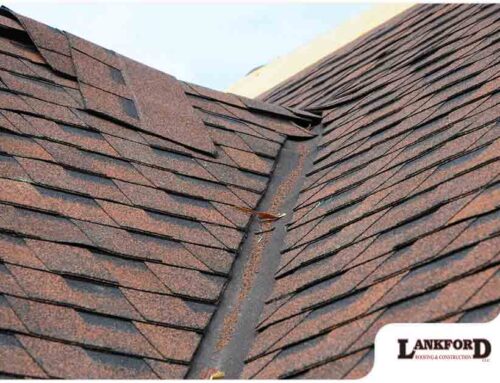

Roofs serve as the home’s primary protection against the elements. They are also subject to constant wear and tear the moment installation is done. Insurance providers tend to favor strong roofs, those that have above-average durability, because it simply doesn’t make sense to provide insurance coverage for something that easily breaks.

Roofing contractors insist that the newer the roof, the better your home insurance rate. Indeed, when you have an older roof with unforeseen issues, such as water damage, you’ll have a hard time guaranteeing coverage.

What You Should Do

- Adherence to manufacturer-prescribed roof inspections and scheduled maintenance, along with timely repairs, can positively affect the roof’s insurance rates.

- Keeping up with scheduled roofing inspections, conducting regular inspections and calling your roofing contractor for maintenance is beneficial to both your roofing structure’s integrity and your insurance rates.

- Document the condition of your roof every now and then. Before and after photos will accurately depict the severity of roof damage for a potential insurance claim.

We Look Forward to Working With You!

To learn more about what Lankford Roofing & Construction LLC can do for you, don’t hesitate to give us a call today at (903) 364-6183 for Texas and at (580) 920-1433 for Oklahoma. We also have a contact form you can quickly fill out to get in touch with us, and we’ll get back to you right away with your FREE quote.